There are certain terminologies in the site that requires definition in order to convey the messaging in our eBILIS® Solution sets. You will find it here and if you would like to obtain more information, please email info.us@ebilis.com.

Credit Push

According to NACHA (National Automated Clearing House Association):

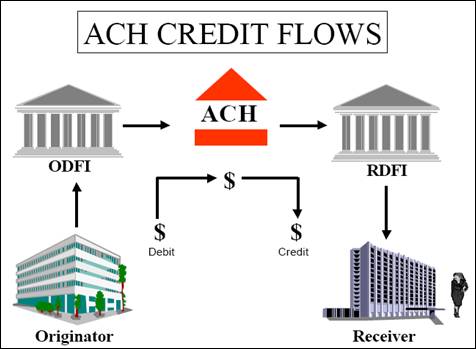

Credit Push is a transfer of funds where the originator initiates a transfer to move funds into the receiver’s account.

In layman’s terms:

Originator – John; Receiver – Bill

- John has $10 in his pocket.

- John owes Bill $8.

- John takes $8 from his pocket and pays Bill.

Advantage of Credit Push

Provides “finality” in the transaction. Since the originator or the paying customer “took” money from his or her account to pay the receiver or the supplier, he or she is in agreement with the goods or services being rendered or supplied.

The originator or the paying customer does not have to provide his or her banking information to the receiver of the funds.

The receiver of the funds will have all the necessary information as a part of the payment process. We call this the Addenda which is the invoice content for easy reconciliation on the receiver side.

Debit Pull

According to NACHA (National Automated Clearing House Association):

Debit Pull is the transfer of funds where the receiver initiates a transfer of funds from the originator’s account.

As consumers, we are quite familiar with this process when we pay our mortgage and utility bills – there is an automatic debit in your account monthly.

In layman’s terms:

Originator – John; Receiver – Bill

- John has $10 in his pocket.

- John owes Bill $8.

- Bill takes $8 from John’s pocket.

Straight Through Payment Processing

According to Wikipedia:

Straight Through Processing (STP) enables the entire trade process for capital markets and payment transactions to be conducted electronically without the need for re-keying or manual intervention, subject to legal and regulatory restrictions.

Simply put, the goal of STP is to enable electronic information that has been entered to be transferred from one party to another in the settlement process without manually re-entering the same pieces of information repeatedly over the entire sequence of events.

Shortening transaction-related processing time, STP provides for reductions in settlement risk by increasing the probability that a contract or an agreement is settled on time, while optimizing the speed at which transactions are processed.

eBILIS® delivers on this concept without traditional integration or the constraints imposed by standards, file formats, file transmission types or dependencies on networks.